Small Business Accountants - Questions

About Small Business Accountants

Table of ContentsSome Ideas on Small Business Accountants You Should KnowThe smart Trick of Small Business Accountants That Nobody is DiscussingThe Main Principles Of Small Business Accountants What Does Small Business Accountants Mean?

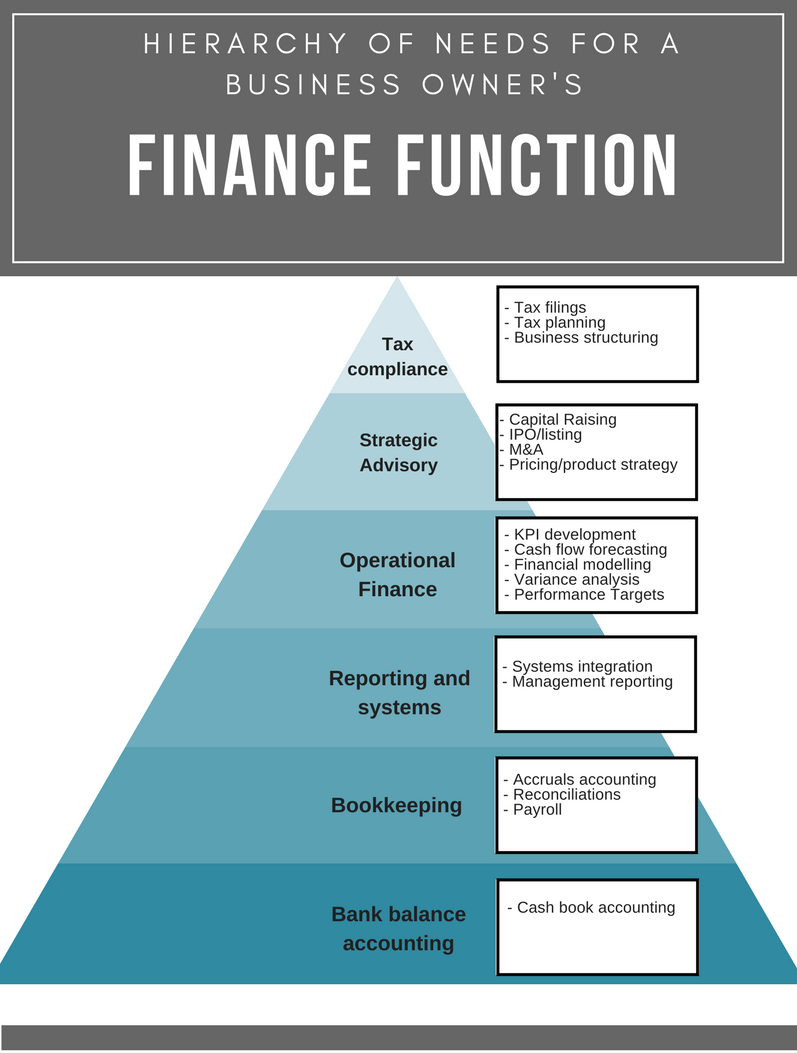

One more major advantage of working with a bookkeeper is that they are competent in analyzing where a business stands on a monetary level. This aids firms make well-informed monetary decisions. Considering that bookkeeping can be extremely laborious, hiring an accountant releases up more time for you as well as your staff members to spend on your main obligations (small business accountants).

Because the software a bookkeeper utilizes is vital to their ability to complete their tasks in a prompt and effective style, you need to constantly ask your candidates which sorts of software application they are experienced in. If you currently have software program that you desire them to use, you ought to ask if they have experience utilizing that program or similar ones.

Whether you work with an accounting professional, an accountant, or both, it's important that the individuals are certified by requesting for customer referrals, examining for certifications or running screening examinations. Bookkeepers "might not always be accredited as well as the obligation is extra on experience," kept in mind Angie Mohr in an Intuit blog site post. Uncertain where to start? See our guide to selecting an organization accounting professional.

Small Business Accountants Fundamentals Explained

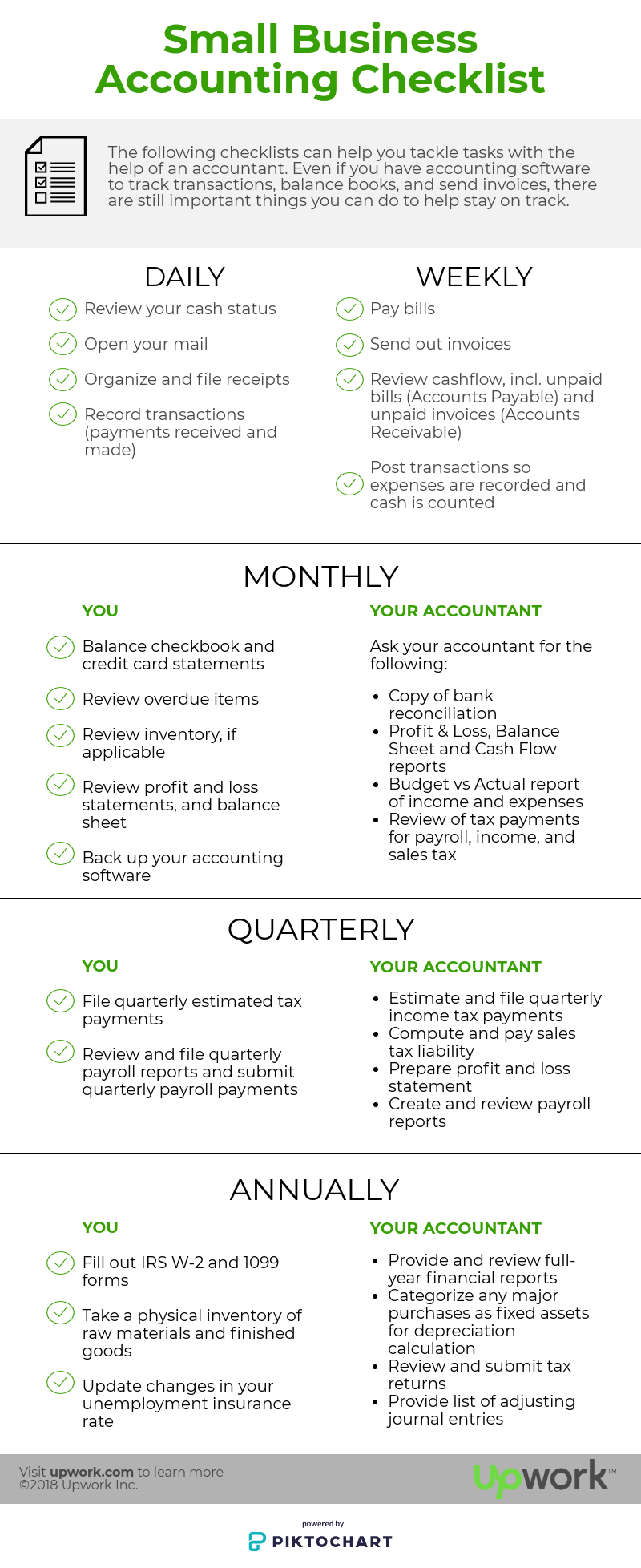

They can aid your company communicate with the federal government in various other means. Full as well as submit the needed legal and also compliance documents for your company, Keep your company as much as day with the most up to date tax laws, Prepare annual declarations of accounts, Maintain your business's status upgraded in the federal government's business register, Maintain records of directors and also other administrative personnel, Organise as well as record share/stock allowance, such as when the organization is developed when a company partner leaves or a brand-new companion joins, Handle your pay-roll as well as ensuring that all staff members' tax obligation codes and settlements are taped properly.

That is if those clients had not waited so long to request for assistance. The bottom line is that there are a number of essential times in the training course of your service when you don't intend to wing it without an accounting professional. Forming Your Organization, The formation of your organization is among those key times.

Compliance and Tax Concerns, Even if your service strategy is written, you have all the called for permits as well as licenses, and your bookkeeping software application is new and glossy and prepared to go you're not quite prepared to move forward without an accounting professional. There are still dozens of compliance stumbling blocks to overcome.

Sales tax conformity in the US is swiftly ending up being a headache. If you'll be delivering your products out of stateor in some situations, also within the same stateyou'll intend to make certain you visit this web-site adhere to all the relevant tax legislations. There are applications to aid with this on a continuous basis, however you'll desire an accountant to help you obtain every little thing set up.

The Single Strategy To Use For Small Business Accountants

Wage and work compliance problems can sink also the most lucrative businesses. Similar to sales taxes, there are apps as well as programs that can assist you with compliance on an ongoing basis, but you'll want an accounting professional to look over your shoulder at the very least quarterly. Other reporting requirements. These can be demands for creditors or licensing firms.

Going into purchases: Deals got in might consist of sales made, expense of materials acquired, worker settlement and advantages, hours worked, rent, IT, insurance, workplace materials, and various other costs paid. Reporting real results or the estimates of future results: Reports might cover the status of possible customers, sales made, sales made where consumers have not yet paid, expenditure comparisons with the my site budget as well as same duration last year, all types of tax records, financial declarations, and details needed to please small business loan agreements.

The 3 options are to do it yourself, appoint someone on your group to do it or to contract out to a bookkeeper or accounting professional. Typically with a startup, you are the only worker, and also there are limited funds available, so initially, the creator regularly does all the bookkeeping. As quickly as you have sufficient discretionary funds, you can take into consideration contracting out the task.

You can likewise position ads in your local paper, on Craigslist or various other such forums, or go to the American Institute of visit the site Specialist Bookkeepers. Do not Outsource It as well as Forget It (small business accountants). Take into consideration outsourcing to an accountant and/or accountant if you do not have the time, abilities, or disposition to do this job.

6 Easy Facts About Small Business Accountants Described

Possibly half the accounting professional's time is invested dealing with the 'documents' the company is continuously producing concerning its earnings and costs, as well as possibly the other half of his time is spent in appointment with you on accountancy technique. This will include his suggestions, based upon the financials, on how to best spend your company's money on resources called for to keep the service successful.

It could cost you a couple of hundred bucks, however that's a little investment because of the effect an accountant can have on your local business. And also if you intend to be amongst the 89% of local business owner who see a bump from functioning with an economic pro, after that start your search for an accounting professional currently.